Update: March 6, 2024

Today, March 6th, 2024, the U.S. Securities and Exchange Commission (SEC) made a decisive move by finalizing its Climate Disclosure Rule during an Open Commission Meeting. This landmark decision aims to embed climate considerations firmly within financial reporting across the United States, marking a significant step towards transparency and accountability in the corporate sector.

Here's a quick summary of what this means:

- Mandatory Disclosures: Publicly traded companies are now required to disclose a comprehensive array of details regarding their greenhouse gas (GHG) emissions. This includes direct emissions (Scope 1), indirect emissions from purchased electricity or other forms of energy (Scope 2), and, critically, when material, emissions from their value chain (Scope 3).

- Impact on Business: Alongside GHG emissions, companies must also elucidate the impact of climate-related risks on their operations, financial health, and strategic direction. This move is designed to offer investors clear, comparable insights into corporate strategies for addressing climate change and the associated risks.

- Timeline and Phasing: The rules introduce a phased compliance strategy, with reporting on Scope 1 and Scope 2 emissions starting in fiscal years beginning in 2026. However, the full extent of reporting, including the specifics around Scope 3 emissions where relevant, will evolve as companies adjust to these new requirements.

- Strategic Implications: The SEC’s Climate Disclosure Rule goes beyond compliance, marking a pivotal shift in corporate governance and strategy. It underscores the growing imperative for businesses to weave sustainability deeply into their strategic frameworks. This regulatory evolution signals to the market that transparency, accountability, and proactive climate risk management are now fundamental components of corporate value. Consequently, it may catalyze a realignment of investment flows, favoring companies that demonstrate robust climate governance and a commitment to sustainable development.

As we navigate this new regulatory environment, Arbor is here to assist companies in understanding and implementing the SEC’s Climate Disclosure Rules. Our expertise in carbon calculations and reporting ensures that your business can not only meet these new standards but leverage them to highlight your commitment to sustainability.

Our suite of tools and services is designed to simplify the compliance process, from calculating Scope 1, 2, and 3 emissions to compiling and reporting the required information in line with SEC guidelines. Moreover, our strategic insights into carbon management and sustainability can help your company turn these new requirements into opportunities for growth, efficiency, and competitive advantage.

Update: March 4, 2024

On March 6th, 2024, the U.S. Securities and Exchange Commission (SEC) is poised to decide on the final version of its climate disclosure rule during an Open Commission Meeting. This vote represents a significant step toward integrating climate considerations into financial reporting across the United States. While we outline the proposed requirements below, it's important to note that the specifics of these rules are subject to the outcomes of the March 6th vote. The final rule could bring about nuanced changes to what has been proposed, emphasizing the importance of staying abreast of these developments for the most accurate and actionable information.

Under the proposed framework, publicly traded companies will be required to disclose comprehensive details about their greenhouse gas (GHG) emissions—covering direct, indirect, and, when material, value chain emissions. Additionally, companies must report on the impact of climate-related risks on their operations, financial health, and strategic outlook. These disclosures aim to provide investors with transparent, comparable insights into how companies address climate change, highlighting the growing acknowledgment of climate risks as critical financial concerns. This move is expected to foster greater transparency and encourage companies toward more sustainable practices.

As we approach this pivotal regulatory milestone, our team at Arbor is diligently preparing to analyze the implications of the final rule for the corporate sector and the broader investment landscape. We encourage you to stay connected with us for comprehensive coverage on the SEC's climate disclosure rule and its potential impact on the business world.

Introduction

Amid escalating concerns about climate change and its ramifications for businesses and investors alike, the U.S. Securities and Exchange Commission (SEC) has proposed new climate disclosure rules. These rules are designed to heighten transparency and arm investors with essential information regarding the climate-related risks and opportunities confronting public companies.

As of March 6th, 2024, the U.S. Securities and Exchange Commission (SEC) has finalized its Climate Disclosure Rules, marking a significant advancement in integrating climate considerations into financial reporting across the United States. This definitive step enhances transparency and equips investors with vital information on climate-related risks and opportunities faced by public companies.

This blog dives into the key facets of the SEC's Climate Disclosure Rules, elucidating who is required to comply, the nature of the requirements, the timeline for mandatory compliance, their significance, and the potential repercussions on sustainability strategies.

What are the SEC’s Climate Disclosure Rules?

The SEC’s Climate Disclosure Rules represent a set of proposed regulatory changes aimed at enhancing and standardizing the reporting of climate-related information by publicly traded companies registered with the U.S. Securities and Exchange Commission (SEC).

The Climate Disclosure Rules require publicly traded companies to disclose specific details about their greenhouse gas (GHG) emissions, focusing on direct (Scope 1) and indirect emissions from purchased energy (Scope 2). Contrary to initial proposals, the mandatory disclosure of Scope 3 emissions—pertaining to value chain emissions—is not universally required, highlighting the SEC's tailored approach to addressing the complexities and challenges of tracking these emissions.

Who needs to comply with the SEC’s mandatory disclosure rules?

The SEC's new rule showcases a balanced approach towards greenhouse gas emissions reporting. Although disclosure of Scope 1 and Scope 2 emissions is mandatory for all covered entities, the requirement to report Scope 3 emissions caters to the materiality and specificity of a company's circumstances. This nuanced requirement ensures that companies provide meaningful and material information pertinent to their business and environmental impact.

What is the timeline for SEC’s Climate Disclosure Rules?

The SEC's final rule employs a phased compliance approach, mandating companies to start reporting on Scope 1 and Scope 2 emissions for fiscal years beginning in 2026.

The roadmap for incorporating Scope 3 emissions into these disclosures depends on their materiality and relevance to the company's overall emission profile. Companies should assess the significance of Scope 3 emissions in their operations and start preparing accordingly.

What are the requirements of the SEC’s Climate Disclosure Rules?

The full requirements are extremely detailed. However, the SEC’s Climate Disclosure Rules are a groundbreaking stride towards greater transparency and accountability in how public companies report their climate-related actions and impacts. These rules are designed to give investors a clear picture of the risks and opportunities companies face due to climate change. Here's a more detailed breakdown of these requirements:

Financial Statement Footnote Disclosures

Under the SEC's proposed climate disclosure rules, financial statements must now incorporate detailed footnotes that elucidate the financial ramifications of climate-related events and activities on a company's financial position and performance. These disclosures are designed to enhance investor understanding of the financial impacts related to climate change, including:

- Impact of Climate-related Events and Transition Activities: Companies are required to disclose significant financial impacts stemming from climate-related events (such as severe weather, wildfires, or floods) and transition activities towards low-carbon operations. This includes detailing the nature and financial magnitude of such impacts, such as impairment charges, asset write-downs, or changes to loss reserves, particularly when these impacts are material to the financial statements.

- Expenditures on Climate Risk Mitigation: Firms must disclose expenditures aimed at mitigating climate risks, including investments in resilience and adaptation measures. This disclosure should provide insights into the scope and scale of a company's commitment to addressing climate-related risks.

- Effect on Financial Assumptions and Estimates: The footnotes must also cover how climate-related events and transition activities have influenced the company's accounting estimates and judgments. This includes changes to depreciation rates, asset valuations, or any provisions for future liabilities associated with climate risks.

By mandating these disclosures, the SEC aims to foster greater transparency, allowing investors to make more informed decisions based on the financial implications of climate risks and opportunities faced by companies.

GHG Emission Disclosures

A critical component of the SEC rules is the detailed reporting on greenhouse gas (GHG) emissions, including:

Scope 1 and Scope 2 Emissions

Companies are required to provide detailed accounts of their direct (Scope 1) and indirect (Scope 2) greenhouse gas (GHG) emissions. These emissions must be reported both disaggregated, by each GHG type, and aggregated, to present a comprehensive view of the organization's total emissions. Additionally, companies must disclose emissions intensity, offering a ratio such as tons of CO2 per dollar of revenue, to provide context on emissions relative to company size or output.

Qualitative Disclosures

These rules also require companies to provide qualitative insights into how they manage climate-related risks and opportunities:

- Impact on Business and Financial Statements: Companies must describe how climate risks have affected or are likely to affect their business model, strategy, and financial outlook.

- Risk Management Processes: There's a requirement to detail how the company identifies, evaluates, and manages climate risks and whether these processes are integrated into the broader risk management strategy.

- Internal Carbon Pricing and Scenario Analysis: If applicable, companies must disclose their internal carbon pricing, the methodologies behind it, and any scenario analysis used to assess climate risks.

- Climate Transition Plans: A detailed description of these plans and their progress must be provided for companies that have adopted transition plans towards lower carbon operations.

Governance Disclosures

The oversight of climate-related risks by a company’s board and management must be detailed, giving investors insight into the governance structures in place to manage these issues.

Location, Timing, and Applicability

These disclosures are required in a company’s annual reports and registration statements, with specific financial disclosures integrated into the financial statements and other disclosures placed in a new section of Form 10-K.

Attestation Requirements and Phase-In Period

The SEC has outlined a phase-in period for these rules, with Scope 1 and Scope 2 emissions requiring third-party assurance after an initial phase. Smaller reporting companies have exemptions and extended timelines for certain disclosures.

The SEC’s Climate Disclosure Rules are a comprehensive framework designed to ensure that investors can access all relevant information regarding a company's climate-related risks and actions. By adhering to these rules, companies comply with regulatory requirements and demonstrate their commitment to transparency and accountability in addressing the challenges posed by climate change.

Companies need to stay informed about the phased implementation of the SEC’s rules, starting with immediate reporting obligations for Scope 1 and Scope 2 emissions in fiscal years beginning in 2026. It's crucial to initiate preparatory measures now, considering the complexity and depth of reporting required.

Why should you care about the SEC’s Climate Disclosure Rules?

The proposed regulation holds significant implications for both companies and investors. Here's why you should care:

Fines/Penalties

Non-compliance with the SEC's Climate Disclosure Rules may expose companies to significant legal and financial risks, including penalties, fines, and potential legal action. The SEC has underscored its commitment to enforcing these rules to ensure that investors have access to transparent and comparable climate-related information across all sectors. Companies are advised to meticulously adhere to these guidelines to avoid potential enforcement actions that could impact their reputation and financial standing.

Transparency and Accountability

These rules will promote transparency in how companies manage climate risks and opportunities, enhancing accountability and fostering trust among investors and stakeholders.

Risk Management

Climate change poses tangible financial risks, from regulatory changes to physical damage from extreme weather events. Understanding and disclosing these risks can help companies better manage them.

Competitive Advantage

Early adopters of strong climate disclosure practices may gain a competitive advantage as investors increasingly prioritize sustainable investments.

Regulatory Compliance

Complying with these rules will be a legal obligation for publicly traded companies, and non-compliance could lead to regulatory repercussions.

How will the SEC’s Climate Disclosure Rules affect your company?

The impending SEC regulation concerning climate disclosure marks a monumental transformation in the regulatory environment. Although the exact details of the rule are still somewhat ambiguous, its implementation is a certainty. This rule isn't merely a matter of compliance; it also presents a chance for companies to harmonize their efforts for decarbonization with the pressing demands of addressing climate change.

The proposed rules may require adjustments for companies with existing sustainability strategies to ensure compliance. They may also necessitate a more comprehensive approach to climate risk management and emissions reduction. On the positive side, they can serve as a catalyst for strengthening sustainability practices and attracting environmentally conscious investors.

How Arbor can help your company with the SEC’s Climate Disclosure Rules?

As the SEC’s Climate Disclosure Rules set a new standard for transparency and accountability in reporting climate-related risks and emissions, companies face the challenge of adapting to these requirements. This is where Arbor steps in, offering tailored solutions to ease this transition and ensuring your company meets and exceeds these new reporting standards.

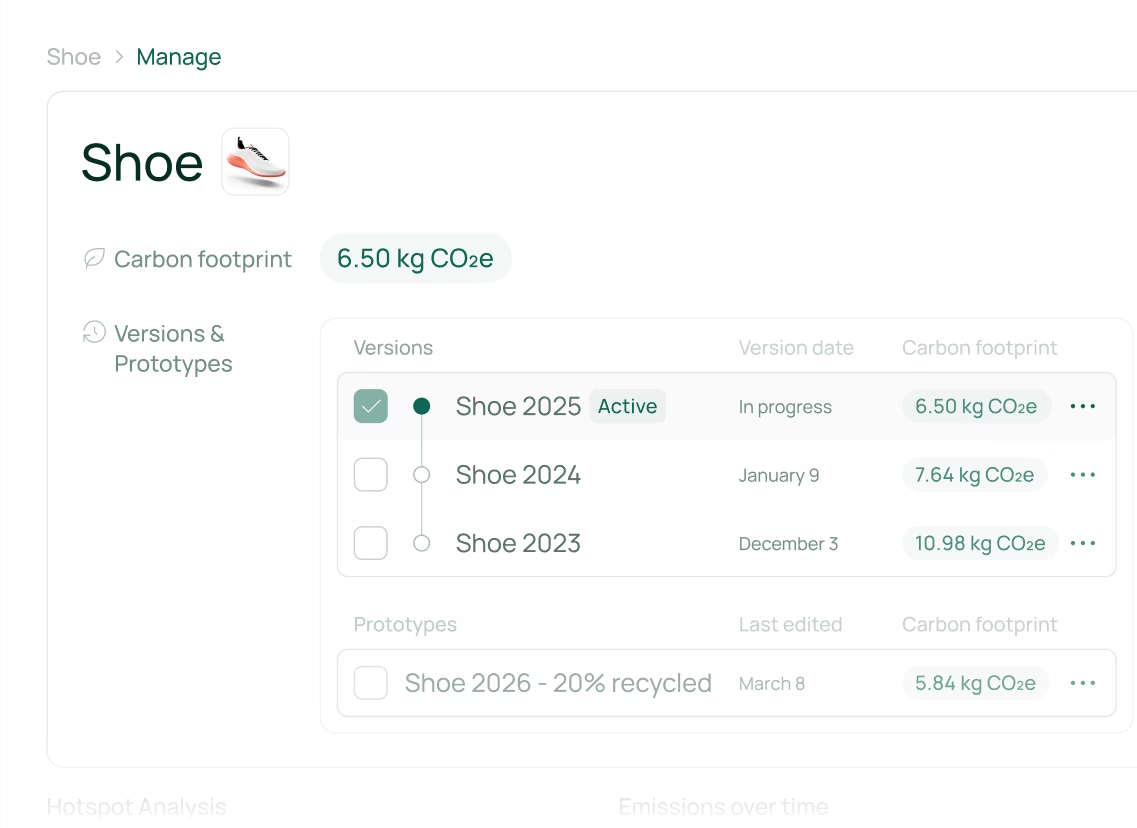

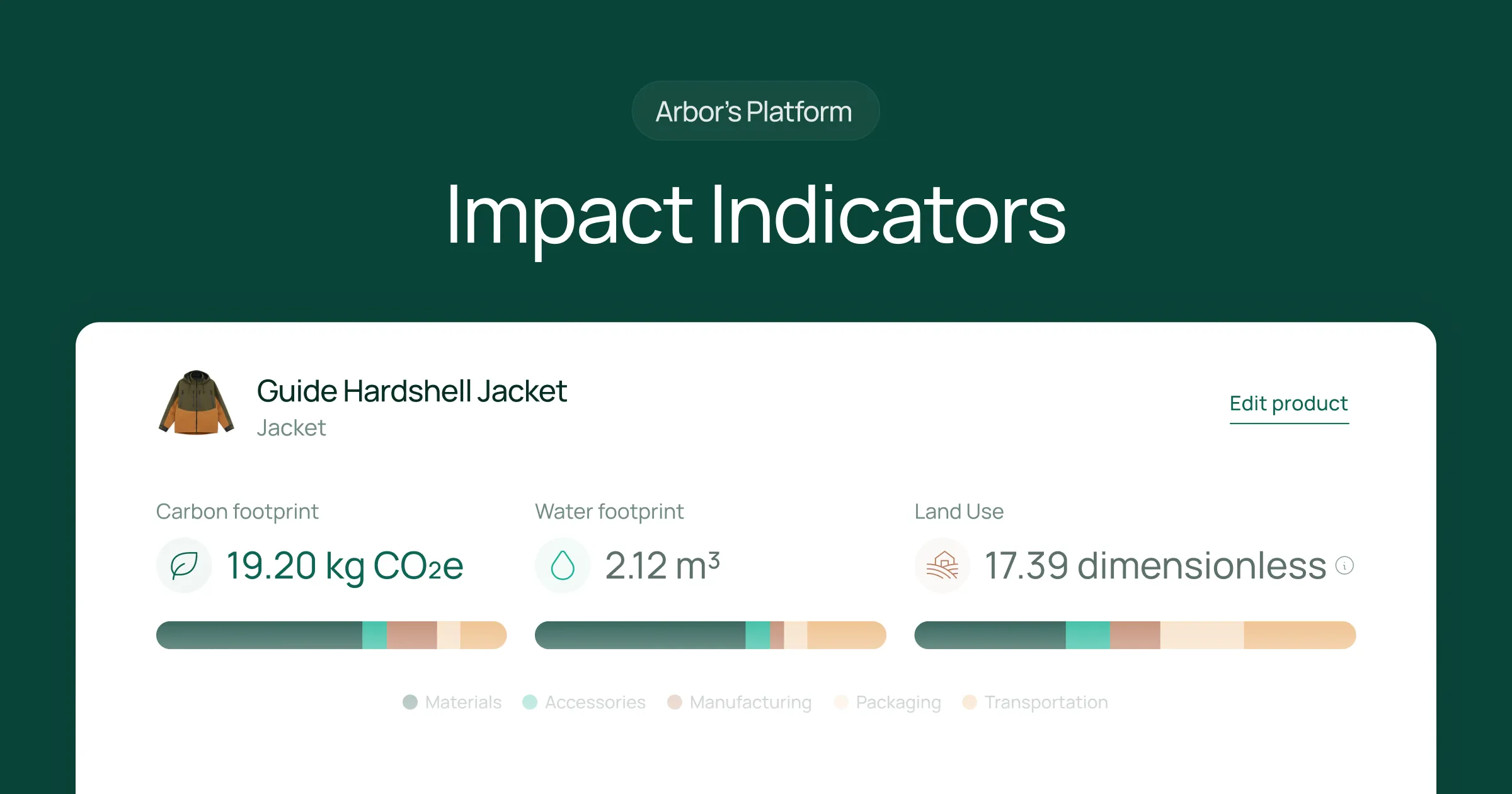

Accurate carbon calculations for Scope 1, 2, & 3 emissions

At the heart of the SEC’s disclosure requirements is the need for detailed reporting on greenhouse gas (GHG) emissions, including Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (all other indirect emissions in a company’s value chain). Arbor’s carbon calculator is designed with industry-leading accuracy to measure your company’s carbon footprint across all three scopes. Our tool simplifies the complex process of gathering and analyzing data, offering you clear insights into your emissions profile.

Compliant carbon reporting

Understanding the intricacies of the SEC’s reporting requirements can be daunting. Arbor’s platform is equipped to generate compliant reports that align with the SEC’s mandates. Our reporting tools are developed to present your data in a clear, comprehensible format that meets the regulatory standards, ensuring that your submissions to the SEC are both compliant and of high quality.

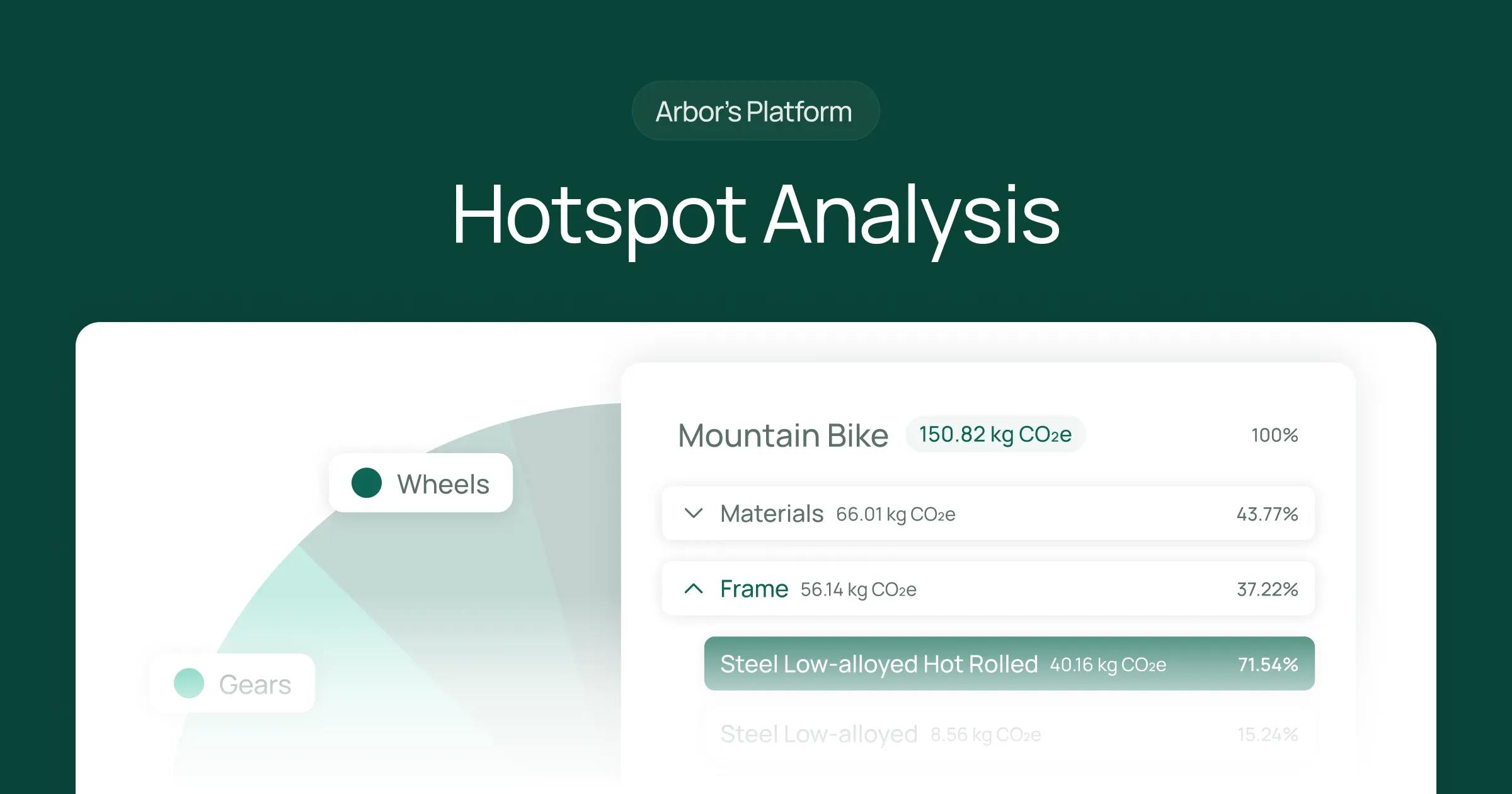

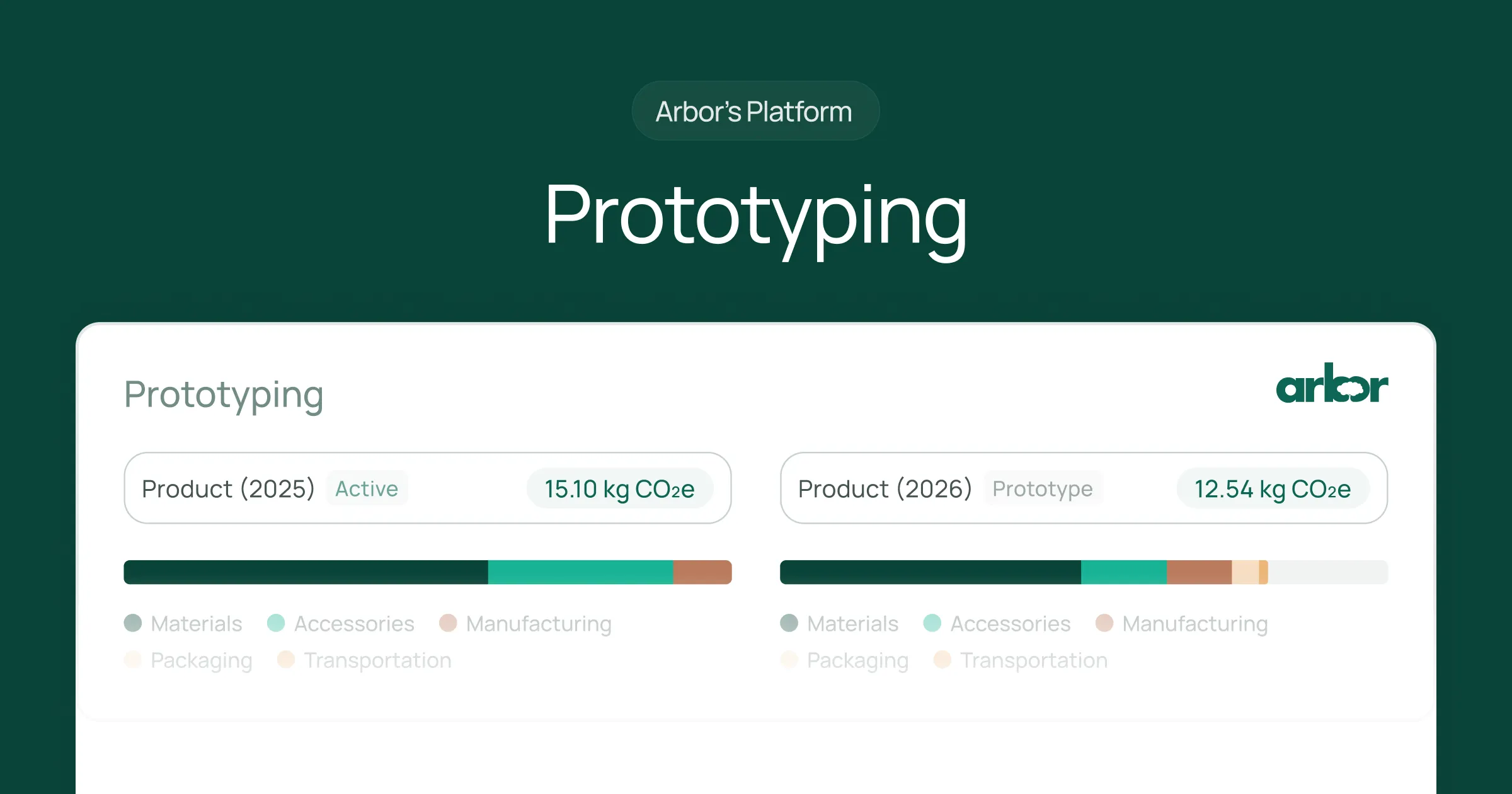

Stay ahead with Arbor. Arbor’s carbon insights offer strategic advice on managing your carbon footprint. By identifying carbon hotspots and advising on sustainable procurement, Arbor empowers your company to make informed decisions that comply with the SEC’s rules and advance your sustainability goals.

Let Arbor help you turn the compliance challenge into an opportunity for growth. Contact us today to learn more about how we can support your company’s journey toward meeting and surpassing the SEC’s Climate Disclosure Rules.

Summary

As the SEC gears up to finalize its Climate Disclosure Rules on March 6th, 2024, the corporate world stands on the brink of a significant shift. This move underscores the growing integration of climate considerations into financial reporting, aiming to provide investors with transparent, comparable insights into how companies address climate change. The proposed rules call for detailed disclosures on greenhouse gas emissions, including direct, indirect, and, when significant, value chain emissions, alongside the impact of climate-related risks on company operations. This initiative reflects a broader recognition of climate risks as pivotal financial concerns, pushing companies towards greater transparency and sustainable practices.

Arbor is at the forefront, ready to guide companies through these changes. Our suite of tools offers accurate carbon calculations for Scope 1, 2, and 3 emissions and compliant reporting to meet SEC mandates. Beyond compliance, Arbor provides strategic insights for effective carbon management, helping companies meet regulatory requirements and seize opportunities for sustainability leadership. As we navigate these regulatory waters, Arbor stands as a beacon for companies aiming to align their sustainability efforts with the evolving demands of climate disclosure. Stay connected with Arbor for the latest insights and support in mastering the SEC’s Climate Disclosure Rules.

Stay ahead with the SEC Climate Disclosure regulation and book a call with our climate experts.

Measure your carbon emissions with Arbor

Simple, easy carbon accounting.

FAQ on the SEC’s Climate Disclosure Rule

Does the SEC Climate Disclosure require Scope 3 Reporting?

The SEC's Climate Disclosure Rules primarily mandate direct (Scope 1) and indirect (Scope 2) GHG emissions reporting. Scope 3 emissions reporting, which covers the broader value chain, is encouraged but mandated only when these emissions are considered material to the company's environmental impact or if the company has established GHG reduction goals that include Scope 3 emissions. This approach acknowledges the complexity and the significant variability in Scope 3 emissions across different industries.

What scopes are mandated in the SEC Climate Disclosures?

The SEC requires large public companies to report Scope 1 and Scope 2 emissions. Scope 3 reporting is conditional, based on materiality and whether companies have included Scope 3 in their GHG emissions reduction targets.

How will the SEC climate disclosure rule impact international corporations operating in multiple countries?

The SEC climate disclosure rule will require international corporations to navigate varying local regulations alongside U.S. requirements, potentially complicating compliance efforts. Companies must harmonize their reporting to meet the SEC's standards without conflicting with regulations in other countries where they operate, making it crucial to adopt a globally coherent carbon management and reporting strategy.

What are the specific challenges companies might face in collecting and reporting Scope 3 emissions data under the new rule?

Collecting and reporting Scope 3 emissions data can be challenging due to the indirect nature of these emissions, which include all other indirect emissions that occur in a company's value chain. Companies might struggle with data availability, quality, and consistency across their supply chains, requiring robust tracking systems and collaboration with suppliers to measure and report these emissions accurately. Arbor can help fill the gaps in your data with our large, trusted secondary data on emissions.

How can companies integrate the new disclosure requirements into their sustainability and ESG reporting frameworks effectively?

Companies should first assess gaps between their reporting practices and the SEC's requirements to integrate the new disclosure requirements. Incorporating the new rules may involve updating data collection methodologies, enhancing reporting systems, and possibly retraining teams. Aligning the SEC disclosures with existing sustainability and ESG frameworks can streamline the process, ensuring consistency and reducing redundancy.

What are the consequences for companies that fail to comply with the SEC climate disclosure rule?

Non-compliance with the SEC climate disclosure rule can lead to legal and financial repercussions, including penalties, fines, and potential legal action. Beyond regulatory consequences, companies may also face reputational damage, loss of investor confidence, and decreased market value, highlighting the importance of adherence to the new disclosure standards.

How does the SEC climate disclosure rule intersect with voluntary carbon reporting standards and frameworks already adopted by companies?

The SEC climate disclosure rule complements voluntary carbon reporting standards by formalizing certain reporting practices. Companies already engaged in voluntary reporting may find it easier to adapt but should still review and adjust their reporting to ensure full compliance with the SEC's specific requirements. This alignment can enhance the credibility and comparability of climate disclosures across the market.

Can the SEC climate disclosure rule influence investment decisions, and if so, how should companies prepare?

Yes, the SEC climate disclosure rule can significantly influence investment decisions by providing investors with standardized, transparent information on companies' climate risks and management strategies. Companies should prepare by ensuring their disclosures are comprehensive, accurate, and reflective of genuine climate action, thereby positioning themselves as attractive investments for sustainability-minded investors.

What best practices can companies adopt to ensure accuracy and reliability in their climate-related disclosures under the new rule?

Under the new rule, companies can leverage Arbor's suite of carbon management tools to ensure accuracy and reliability in their climate-related disclosures. Arbor's Carbon Calculator facilitates the collection of accurate emissions data by automating the process and integrating both primary and secondary data sources, reducing the likelihood of errors. Additionally, Arbor's Carbon Reporting feature, certified by the GRI, provides a structured framework for reporting that aligns with regulatory requirements, ensuring that disclosures are comprehensive and compliant. By utilizing Arbor, companies can streamline their data management processes, making it easier to engage third-party auditors for verification with well-organized and transparent data. Furthermore, Arbor offers resources and support that can be used for staff training, enhancing their understanding of carbon accounting principles and reporting standards, thus improving the overall quality and consistency of climate-related disclosures.

.webp)

%20Directive.webp)

.webp)

%20Arbor.avif)

%20Arbor.avif)

.avif)

%20Arbor%20Canada.avif)

.avif)

%20Arbor.avif)

.avif)

_.avif)

.avif)

%20Arbor.avif)

%20Software%20and%20Tools.avif)

.avif)

.avif)

%20EU%20Regulation.avif)

.avif)

%20Arbor.avif)

_%20_%20Carbon%20101.avif)

.avif)