Financial institutions find themselves in a precarious situation where inaccuracies or incomplete disclosures could not only lead to public scrutiny and a loss of trust but also unnecessary business losses as a result of ill-prepared processes in the wake of new emissions-related criteria required for loan adjudication. Driven by the urgency of global climate change and the emergence of stringent regulations such as Article B-15 in Canada, from the Office of the Superintendent of Financial Institutions (OSFI), financial institutions must innovate their practices, fast.

To accurately report financed emissions in compliance with imminent climate disclosure legislation like B-15, distinct sets of carbon emissions data need to be accessible and subsequently tailored for various sizes and forms of loans. This can only be achieved once risk measurement frameworks–the foundation and seed of entire chains of climate finance reporting–are tailored to the array of loans first. By unlocking climate-related data in this way, more loans can be underwritten and monitored in accordance with green protocols and frameworks that would have otherwise fallen through the cracks.

What Green Financing Options Currently Exist?

In the quest toward net-zero, one of the most critical aspects is financing the necessary projects and initiatives. The Task Force on Climate-related Financial Disclosures (TCFD) has played a pivotal role in promoting transparency and disclosure of climate-related risks and opportunities for investors and businesses. One of the key areas it addresses is the identification and promotion of green financing options. In this section, we will delve into three prominent green financing options: green loans, green bonds, and tax incentives. Alongside these established financial mechanisms, many initiatives also attract corporate support by creating compelling sponsorship packages to fund specific environmental projects.

1. Green Loans

Green loans have emerged as a versatile and accessible financing option for organizations looking to fund eco-friendly projects. These loans are typically structured to incentivize environmentally responsible practices and initiatives. Here's how they work:

- Purposeful Allocation: Green loans are earmarked specifically for environmentally beneficial projects. Whether it's funding renewable energy installations, supporting energy-efficient building retrofits, or promoting carbon-reduced agricultural practices, green loans ensure that borrowed funds are exclusively directed towards green endeavors.

- Reduced Interest Rates: Lenders often sweeten the deal by offering preferential interest rates or favorable terms on green loans. These reduced interest rates serve as a powerful incentive, motivating businesses to embrace and implement net-zero practices.

- Certification and Reporting: To qualify for green loans, borrowers typically must meet stringent environmental criteria. Additionally, they are required to provide regular reports detailing the progress and impact of their green initiatives. This commitment to transparency and accountability guarantees that the funds are used for their intended purposes.

- Third-Party Verification: Many green loans involve the participation of third-party verifiers who meticulously assess and confirm that the funded projects adhere to net-zero criteria. This verification process not only enhances trust among investors and lenders but also underscores the genuine commitment to net-zero within the borrower's organization.

2. Green Bonds

Green bonds have gained significant popularity in the world of sustainable finance. These are debt instruments issued by governments, financial institutions, or corporations, with the proceeds explicitly dedicated to environmentally friendly projects. Green bonds offer several advantages:

- Project Financing: Like green loans, the funds raised through green bonds must be allocated exclusively to projects with environmental benefits. These projects often fall within categories such as renewable energy, clean transportation, or clean infrastructure.

- Transparency: Issuers of green bonds are expected to provide detailed information on the use of proceeds and the environmental impact of the funded projects. This transparency helps investors make informed decisions.

- Market Growth: The green bond market has experienced exponential growth in recent years, attracting a diverse set of investors. This increased demand has led to greater innovation and diversification of green bond offerings.

- Alignment with TCFD Recommendations: Green bonds align well with the TCFD's recommendations by promoting transparency in climate-related financial reporting and investment decision-making.

As green bond initiatives have evolved, Canada has been actively involved as a leader in the issuance of green bonds to fund environmentally friendly projects. Here are just a few examples of Canadian green bond programs:

- Province of Ontario's Green Bond: In 2014, the Province of Ontario became the first province in Canada to issue green bonds. These bonds were used to finance environmentally friendly projects, including public transit expansion, energy-efficient building retrofits, and clean energy initiatives.

- Export Development Canada (EDC) Green Bond: EDC, a federal Crown corporation, issued green bonds to fund projects related to renewable energy, clean transportation, and sustainable water management. These bonds were part of EDC's efforts to support Canadian exporters engaged in environmentally responsible activities.

- City of Toronto Green Bond: The City of Toronto issued its first green bond in 2017. The funds raised were dedicated to projects aimed at reducing greenhouse gas emissions and improving efforts towards net-zero within the city, such as public transportation upgrades and energy-efficient municipal buildings.

- Province of British Columbia's Green Bonds: British Columbia issued green bonds to support projects in renewable energy, clean transportation, and energy efficiency. These bonds were aligned with the province's climate action goals and its commitment to reducing carbon emissions.

3. Tax Incentives

Governments worldwide are recognizing the importance of incentivizing green initiatives through tax incentives. These incentives come in various forms and can benefit both individuals and businesses:

- Investment Credits: Governments may offer tax credits to businesses that invest in renewable energy, energy-efficient technologies, or other environmentally friendly projects. These credits can significantly reduce the cost of such investments.

- Tax Deductions: Certain expenses related to net-zero initiatives, such as research and development for green technologies, may be tax-deductible, reducing a company's taxable income.

- Carbon Pricing: Some regions have implemented carbon pricing mechanisms, such as carbon taxes or cap-and-trade systems. These measures encourage companies to reduce their carbon emissions by making high-emission activities more expensive.

- Consumer Incentives: Governments may provide tax incentives to consumers who purchase electric vehicles, install solar panels, or make energy-efficient home improvements.

Green financing options, including green loans, green bonds, and tax incentives, are instrumental in accelerating the transition to a low-carbon economy. These options not only provide financial support for green projects but also promote transparency and accountability, aligning with the TCFD's principles for climate-related financial disclosure.

Financing Categories with Established Carbon Accounting Methodologies

In addition to TCFD, another important resource that is helping establish carbon accounting methodology is PCAF (Partnership for Carbon Accounting Financials). PCAF plays a pivotal role in advancing transparency and the disclosure of climate-related risks and opportunities for both investors and businesses. Currently PCAF has methodology for 7 lending asset classes:

- Listed equity and corporate bonds

- Mortgages

- Business loans and unlisted equity

- Motor vehicle loans

- Project finance

- Commercial real estate

- Sovereign debt

This represents the preliminary roster of asset classes addressed by PCAF. With input and insights from PCAF participants and users, the initiative aims to refine the methodologies and introduce new ones continually.

Each asset class method includes instructions for calculating absolute emissions, while the project finance method exclusively offers guidance for calculating avoided emissions. The methods for computing emission removals are delineated across three asset classes: listed equity and corporate bonds, business loans and unlisted equity, and project finance.

Asset Level Measurement: Financing That is High Frequency, Low Value Requires a Risk Measurement Framework That is Directly Attributed at an Asset Level

In the rapidly evolving landscape of sustainable finance, the need for a precise and comprehensive risk measurement framework cannot be overstated. While net-zero goals are global in scope, their impact is fundamentally local and tied to specific assets and projects. Recognizing this, the Loan Programs Office (LPO) of the United States has embarked on a significant shift by incorporating quantifiable emissions avoidance metrics into its decision-making process. This shift underscores the importance of developing a risk measurement framework that operates at an asset level, as opposed to broad global averages and how such a change is pivotal in determining whether projects receive approval or rejection from the LPO.

The Limitations of Broad Global Averages

Overlooking Local Variations: Global averages are an essential tool for understanding broad trends, but they often overlook the nuances of individual projects. Averages can hide pockets of inefficiency or excellence within a larger portfolio, making it challenging to distinguish between high and low-impact assets.

Inaccurate Risk Assessment: When risk assessments rely on global averages, they may not adequately capture the specific environmental, social, and governance (ESG) risks associated with individual projects. This lack of precision can lead to inaccurate risk assessments, potentially exposing financiers to unforeseen liabilities.

Inequitable Impact: The impact of climate change-related issues varies significantly by region and industry. A one-size-fits-all approach based on global averages may not account for the disproportionate impact that certain projects can have on local communities and ecosystems.

The Case for Asset-Level Risk Measurement

The case for asset-level risk measurement is compelling on multiple fronts.

- It brings precision and accountability to the forefront, as it allows for the development of a meticulous risk measurement framework. This framework empowers institutions like the LPO to evaluate each project based on its unique merits, ensuring that financial decisions are grounded in specific, actionable data rather than broad generalizations.

- Asset-level measurement champions transparency in a significant way. It motivates project developers to disclose their environmental performance with granular data, fostering transparency that is crucial for tracking progress and upholding compliance with net-zero objectives.

- An asset-level approach offers the invaluable advantage of tailored risk mitigation strategies. This means that projects with the potential for substantial environmental impact can craft and implement specific measures to proactively address and minimize their effects, ultimately advancing responsible low-carbon development.

The US Loan Program Office (LPO) and Quantifiable Emissions Avoidance Metrics

The LPO's decision to integrate quantifiable emissions avoidance metrics into its decision-making process signifies a significant shift toward precision and accountability. Here's why this change is noteworthy:

- Data-Driven Decision-Making: Using emissions avoidance metrics tied to specific projects empowers the LPO to make data-driven decisions. It ensures that financial support is directed toward projects that genuinely contribute to emissions reduction.

- Risk Mitigation: By incorporating emissions avoidance metrics, the LPO is better positioned to assess and mitigate the financial risks associated with climate change. This proactive approach safeguards both the environment and taxpayer investments.

- Incentivization: The LPO's move incentivizes project developers to focus on net-zero objectives and invest in innovative technologies and practices that reduce emissions. This benefits not only the projects themselves but also the broader transition to a low-carbon economy.

The transition to sustainable finance necessitates a shift from broad global averages to asset-level risk measurement frameworks. The Loan Programs Office's adoption of quantifiable emissions avoidance metrics based on specific projects exemplifies this transformation. Embracing asset-level precision not only enhances decision-making accuracy but also promotes transparency, accountability, and tailored risk mitigation strategies. This shift represents a significant step forward in ensuring that financial decisions align with net-zero objectives while protecting both the environment and financial investments.

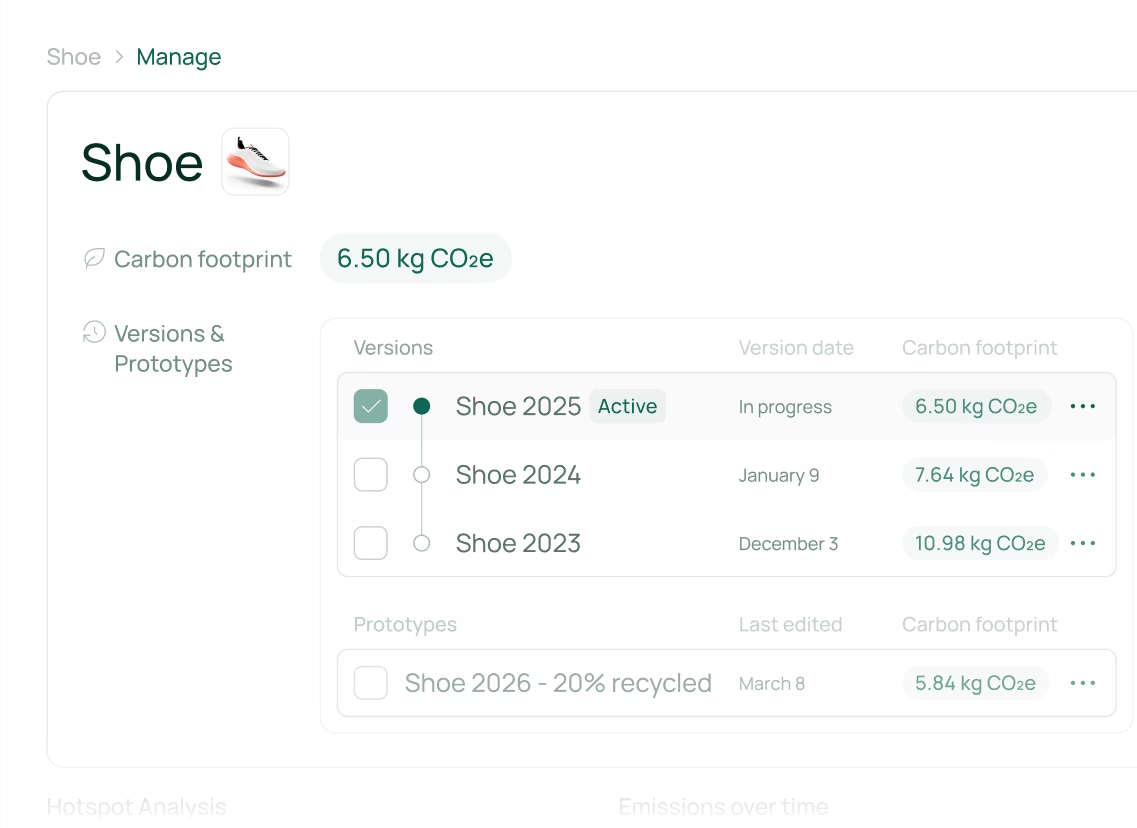

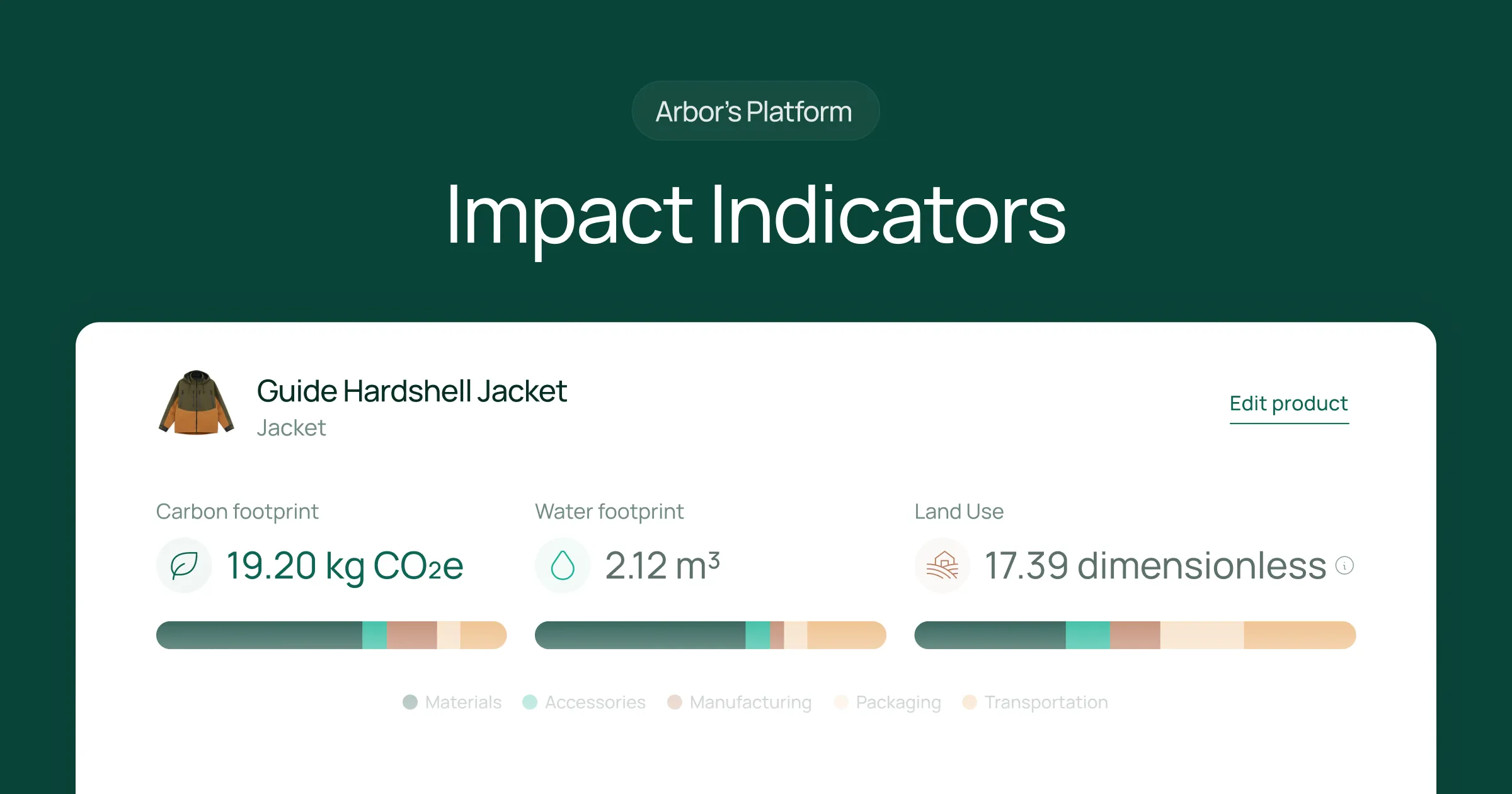

Achieving Asset Level Accuracy

The need for asset-level accuracy is clearly required to advance sustainable finance efforts in a meaningful and impactful way. Arbor is currently conducting a pilot with a number of different municipalities to measure the baseline emissions of their fleet over a period of time.

Financial institutions, municipalities, and organizations worldwide are aligning their strategies with ambitious climate goals. However, achieving these goals necessitates more than just broad, sweeping measures. It demands a granular understanding of the environmental impact of every asset in play, from vehicles to infrastructure.

Asset level accuracy is the linchpin upon which sustainable finance can make a meaningful and impactful difference. To truly assess progress, reduce carbon footprints, and maximize efficiency, stakeholders need to know precisely how each asset contributes to emissions. This information empowers decision-makers to make informed choices, steer investments strategically, and measure their progress against long-term targets.

Arbor's Pioneering Pilot Project

Arbor has recognized the critical role that asset-level accuracy plays in achieving net-zero objectives. To this end, Arbor has embarked on an innovative pilot project in collaboration with municipalities.

The pilot project centers on the meticulous measurement of baseline emissions generated by municipal fleets over an extended period. By gathering and analyzing historical data, Arbor aims to provide municipalities with a clear picture of their current emissions levels. More importantly, Arbor will be able to assess whether these municipalities are on track to meet their 2050 goals of net-zero carbon emissions. Interested in learning more? Contact us!

Quantifying the Benefits of Change

Arbor's pilot project offers more than just a diagnostic tool; it's a catalyst for change. Armed with comprehensive data, municipalities can quantify the environmental benefits of transitioning to fleet options with reduced carbon impact. The insights gleaned from this initiative can inform decisions such as switching to eco-friendly vehicle alternatives or adopting different assets that significantly reduce emissions.

Moreover, Arbor recognizes that implementing eco-friendly changes often comes with financial hurdles. To address this, Arbor is actively exploring and promoting programs that subsidize the costs associated with making carbon-reductive asset changes. These initiatives are designed to alleviate financial burdens and incentivize the adoption of greener, low-carbon alternatives.

In conclusion, achieving asset-level accuracy is not just a prerequisite but a cornerstone for making sustainable finance efforts truly impactful. Arbor's pioneering pilot project with municipalities exemplifies the commitment to this cause. By providing precise data, quantifying the benefits of change, and facilitating financial support, Arbor is leading the charge in enabling sustainable finance to flourish.

Financing That is Low Frequency, High Value

Regional Measurement: Financing That is Low Frequency, High Value Requires a Risk Measurement Framework That is Reliant on Regional Measurement

In the realm of sustainable finance, the term "low frequency, high value" often refers to financial instruments and initiatives that are not deployed frequently but carry significant economic and environmental impact. These could include loans, tax incentives, or investment opportunities aimed at promoting environmentally friendly practices and reducing carbon emissions. When dealing with such high-stakes financial decisions, the importance of regional measurement cannot be overstated.

Linking Low Frequency and High Value

The link between low-frequency financing and regional measurement is crucial. Low-frequency financing options are typically reserved for large-scale projects or initiatives that have a substantial impact on the environment and the economy. In such cases, making informed decisions is paramount, as the consequences of misallocation or inefficiency can be far-reaching.

The Pitfall of Low-Quality Data

One of the primary challenges in making these informed decisions is the availability and quality of data. It's not uncommon to find projects or initiatives relying on low-quality or global-average data to assess their environmental impact. This approach is fraught with pitfalls, as it fails to capture the nuanced regional differences that can significantly affect the outcomes.

Consider the case of two companies operating in vastly different regions: an oil and gas company in Alberta, Canada, and a company in the Middle East. In Alberta, detailed emissions data may be readily available due to rigorous reporting requirements and environmental regulations. However, in the Middle East, obtaining such data may be considerably more challenging. Using global average data in both cases would lead to inaccurate assessments of their carbon footprints.

The Regional Measurement Imperative

To make truly informed decisions when allocating low-frequency, high-value financing, we must prioritize high-quality emissions data that is region-specific. Region-specific data allows for accurate assessments of the environmental impact of a project or initiative, considering factors like local energy sources, transportation methods, and industrial practices that can vary significantly from one region to another. This tailored approach enables financing decisions to address specific environmental challenges in each location, ensuring resources are allocated where they are needed the most, thus maximizing the positive impact. Additionally, high-quality regional data plays a crucial role in mitigating risks associated with low-frequency financing, offering a clearer picture of potential environmental liabilities and enabling more accurate financial planning. Furthermore, utilizing region-specific data promotes transparency and accountability, instilling confidence among stakeholders that financing decisions are based on credible information, thereby reducing the risk of greenwashing or misallocation of funds.

Carbon Measurement in 2026

The nexus between low-frequency, high-value financing and regional measurement is undeniable. To make billion-dollar decisions effectively and responsibly, we must prioritize high-quality emissions data that reflects the specific characteristics and challenges of each region. By doing so, we can ensure that green financing initiatives achieve their intended environmental and economic goals while minimizing risks and maximizing impact. To delve deeper into the impact of regional measurement on sustainable finance, read more about Global Emissions.

Measure your emissions with Arbor. Talk to our carbon experts for a personalized roadmap to green financing for your company.

Measure your carbon emissions with Arbor

Simple, easy carbon accounting.

.webp)

%20Directive.webp)

.webp)

%20Arbor.avif)

%20Arbor.avif)

.avif)

%20Arbor%20Canada.avif)

.avif)

%20Arbor.avif)

.avif)

_.avif)

.avif)

%20Arbor.avif)

%20Software%20and%20Tools.avif)

.avif)

.avif)

%20EU%20Regulation.avif)

.avif)

%20Arbor.avif)

_%20_%20Carbon%20101.avif)

.avif)